Explore complete PayU IPO details – Date, Price Band, GMP, Lot Size, Allotment, Financials, Review, and Company Background.

Introduction – The Buzz Around PayU IPO

Among the most awaited upcoming IPOs in India, the PayU IPO has generated immense curiosity. As India’s digital payments and fintech market continue to surge, investors are eager to know the PayU IPO date, price band, GMP (Grey Market Premium), lot size, allotment, and financial details.

PayU India, backed by Prosus, has long been a key player in the Indian fintech ecosystem. With millions of merchants and a solid foothold in UPI, card, and wallet transactions, PayU’s IPO could be a landmark listing for 2025–2026.

In this detailed PayU IPO review, we’ll explore everything — from business fundamentals and valuation to the PayU IPO allotment date, issue size, expected price, and future potential.

About PayU India – Company Overview

PayU India is one of the country’s leading digital payment gateways, processing transactions across UPI, credit/debit cards, wallets, and EMI options. Founded in 2011, PayU has become a trusted partner for e-commerce platforms, small businesses, and large enterprises.

The company is part of Prosus NV, a global consumer internet group that also backs brands like Swiggy and OLX. Over the years, PayU expanded beyond payments to include lending, BNPL (Buy Now Pay Later), and merchant credit solutions, making it a full-stack fintech player.

Its upcoming PayU India IPO is seen as a major step to unlock shareholder value and bring India’s fintech growth story to public investors.

PayU IPO Date & Schedule

As of now, the PayU IPO open date and closing date have not been officially announced. Initial expectations pointed to a late-2025 listing, but recent reports suggest a possible IPO in 2026.

Tentative Timeline (Expected)

| Event | Expected Date |

|---|---|

| PayU IPO Open Date | To be announced |

| PayU IPO Close Date | To be announced |

| PayU IPO Allotment Date | TBD |

| Refunds Initiation | TBD |

| Credit of Shares to Demat | TBD |

| PayU IPO Listing Date | 2026 (Tentative) |

Keep checking PayU IPO news on trusted financial platforms like NSE, BSE, or Moneycontrol for official announcements.

PayU IPO Price Band, Lot Size & Minimum Investment

The PayU IPO price band has not yet been declared, but analysts estimate it could fall between ₹……. – ₹…… per share, depending on market conditions and valuation.

- Price Band (Expected): ₹…. – ₹…… per share

- Face Value: ₹1 per equity share

- PayU IPO Lot Size: Expected …. shares per lot

- Minimum Investment (Retail): Around ₹14,000 – ₹15,000

Retail investors can apply in multiples of lots, and the PayU IPO allotment will be finalized via a fair draw system as per SEBI norms.

PayU IPO GMP (Grey Market Premium)

Currently, there is no confirmed PayU IPO GMP available because the IPO date and pricing are still pending. However, once the company announces the final price band, the PayU IPO GMP will reflect investor sentiment in the grey market.

Monitoring GMP is useful, but it’s not a guarantee of performance. Investors should focus more on PayU’s financials, revenue growth, and profit potential rather than just GMP.

PayU IPO Financials – Revenue, Profits & Key Metrics

FY2023–FY2025 Highlights (Consolidated)

| Financial Metric | FY2023 | FY2024 | H1 FY2025 |

|---|---|---|---|

| Revenue | $540 Million | $669 Million | $237 Million |

| EBIT (Operating Profit/Loss) | -$32 Million | -$44 Million | Improving |

| Total Payment Volume (TPV) | $70 Billion+ | $90 Billion+ | $50 Billion+ |

| Merchants Served | 500,000+ | 600,000+ | 650,000+ |

PayU’s financial performance shows consistent revenue growth, thanks to India’s digital payment boom. Though it’s still loss-making, losses have been narrowing as the company improves operational efficiency.

Its credit and lending segment (like PayU Credit, LazyPay) is expanding rapidly, positioning it as a hybrid between a payments processor and a fintech lender.

PayU IPO Issue Size & Shareholding Pattern

According to multiple sources, the PayU IPO issue size is expected to be around ₹4,200 – ₹4,500 crore. The offering may include both fresh issue (to raise capital for business growth) and offer for sale (OFS) components (where existing shareholders sell part of their stake).

Expected Shareholding Post IPO

- Prosus NV (Parent Company): Majority stake retained

- Public Shareholding: Approx. 10–15% post-listing

- Employee ESOP Pool: Reserved portion

PayU Business Model Explained

PayU operates under a transaction-based revenue model, earning a fee for each digital transaction processed. Its ecosystem spans:

- PayU Payment Gateway – Accepts cards, UPI, and wallets for merchants.

- PayU Credit / LazyPay – Offers instant credit to users and merchants.

- PayU Finance – Provides short-term business loans to SMEs.

- PayU Hub – Merchant dashboard for analytics and reporting.

This diverse structure allows PayU to tap both consumer finance and merchant solutions, giving it a competitive edge among fintech IPOs in India.

Fintech Market in India – Why PayU IPO Matters

India’s digital payments market is projected to grow at 20–25% CAGR till 2030, driven by UPI transactions, e-commerce, and digital adoption. The PayU IPO 2025 could thus be a major milestone, joining the league of successful fintech listings.

Compared to peers like Razorpay, Pine Labs, and Paytm, PayU holds strong in merchant coverage and transaction volume. Its IPO will also offer investors exposure to India’s fintech innovation ecosystem.

PayU IPO Review – Strengths & Risks

Strengths

- Strong parent backing from Prosus NV

- Large merchant base and payment volume

- Diversified revenue from credit + payments

- Positioned in India’s fastest-growing fintech sector

Risks

- Not yet fully profitable

- High competition from Paytm, Razorpay, PhonePe

- Regulatory uncertainty in fintech and credit products

- IPO delay could affect investor enthusiasm

This PayU IPO analysis shows that while growth is impressive, valuation and timing will be key to investor returns.

Should You Invest in PayU IPO?

Investors considering whether to invest should evaluate:

- Valuation vs Peers: If priced attractively below aggressive valuations, it could offer upside.

- Business Fundamentals: Strong payment processing + credit expansion = long-term potential.

- Profitability Path: Look for signs of breakeven in the DRHP.

- Market Sentiment: If broader IPO markets are bullish, listing gains could be strong.

If you are a long-term believer in digital payments and fintech growth in India, PayU’s IPO can be a good opportunity. However, if you prefer stable, profitable companies, you might wait until PayU’s post-listing performance stabilizes.

PayU IPO Allotment, Listing, and Refunds

Once the PayU IPO closes, investors can check their PayU IPO allotment status on the official registrar’s website using their PAN or Demat number.

Refunds for non-allotted applicants will be processed within a few days. The PayU IPO listing date is expected around 2026 (tentative) on both NSE and BSE.

PayU IPO FAQs

Q1. When is the PayU IPO date?

The PayU IPO open and close dates are yet to be officially declared. Expected timeline: 2026.

Q2. What is the PayU IPO price band?

Expected between ₹….–₹…… per share.

Q3. What is PayU IPO lot size and minimum investment?

Likely ……. shares per lot; retail investment starts around ₹14,000–₹15,000.

Q4. What is the PayU IPO GMP?

Currently no confirmed PayU IPO Grey Market Premium; will update once official.

Q5. What is PayU’s issue size?

Estimated at ₹4,250 crore (combination of fresh issue and OFS).

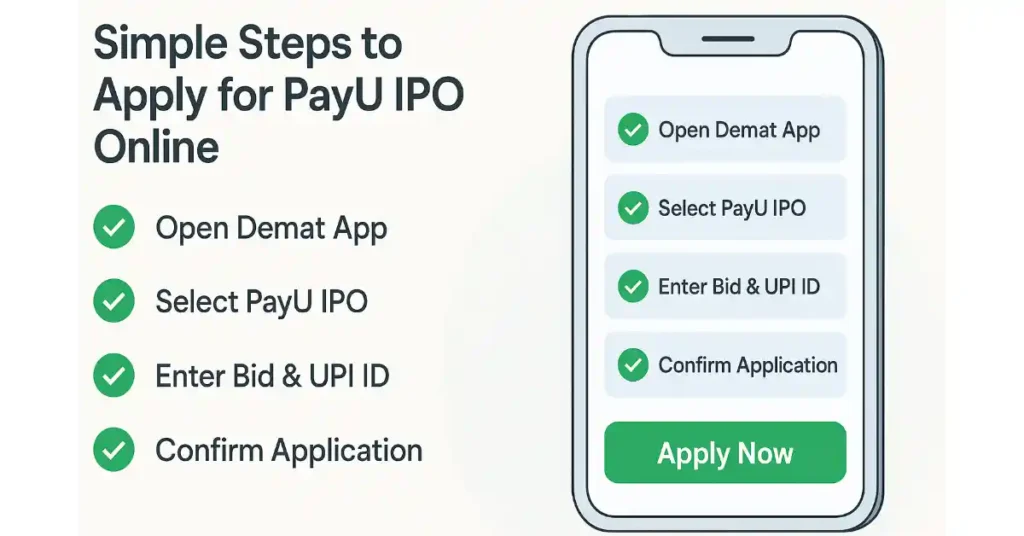

Q6. How to apply for PayU IPO?

You can apply through ASBA via your bank or any online trading platform like Zerodha, Groww, or Angel One.

Q7. Should I invest in PayU IPO?

If you believe in fintech IPOs in India and India’s digital payment growth, PayU IPO could be a potential long-term bet.

Expert Verdict

The PayU IPO is shaping up to be one of India’s biggest fintech IPOs, combining strong growth potential with a proven brand. But investors must weigh the risks of profitability and valuation carefully.

If you’re eyeing listing gains, watch the PayU IPO GMP and subscription numbers once they’re released. For long-term investors, focus on the company’s financials and market position rather than short-term hype.

Conclusion

The PayU IPO 2025/2026 could be a turning point for India’s fintech sector, much like Paytm’s IPO was in 2021. With an expanding merchant base, innovative products, and backing from Prosus, PayU’s entry into public markets may open new opportunities for investors who believe in India’s digital future.

However, always invest after studying the PayU IPO financials, valuation, and market sentiment — because in IPO investing, clarity beats hype.

Disclaimer

The information provided in this article about PayU IPO — including IPO date, GMP, price band, lot size, allotment status, and financial details — is for educational and informational purposes only.

All IPO data mentioned are based on publicly available sources and may change once the company releases its official DRHP (Draft Red Herring Prospectus) and SEBI approval details. Readers and investors are strongly advised to verify the latest information from official channels like NSE, BSE, SEBI, and the company’s website before making any investment decisions.

This blog does not constitute investment advice, financial guidance, or a buy/sell recommendation. Investing in IPOs and the stock market involves market risk, including the possible loss of principal. Always consult a certified financial advisor before investing.

The author and publisher are not responsible for any financial losses arising from actions taken based on this content.